Buy Now, Pay Later in Africa: a strategy to drive inclusion

A recent report by Worldpay from FIS forecasts that BNPL services will steadily gain eCommerce market share, earning nearly 3% of global eCommerce spend by 2023.

It seems too good to be true, right? You went shopping, your eyes fell on a pair of nice shoes. The problem? The price is more than what you’d like to spend right now. You’re about to leave to find something within your budget when you notice a sign that says: “Buy it now, pay later” at zero interest. Seriously? Loud the music plsssssss!

While lots of sectors experienced a dramatic downturn in business during the pandemic, it was different for a particular fintech - the "Buy Now, Pay Later" (a.k.a. BNPL). It was the opposite.

If you’ve paid attention while shopping, it is likely that you would’ve noticed Buy Now Pay Later (BNPL) being increasingly offered by retailers and eCommerce merchants as an alternative way to pay at checkout.

In the last few decades, personal credit transformed from loans to credit cards to the now BNPL trend.

BNPL in Africa

What we are seeing now is what technology know how to do best – enable.

The rise of BNPL is solving two issues – the first is easy access to whatever you need without the attention of FFF (friends, families and foes) in the matter. The second is nobody can shame you when you are late in your payment. I know Sokoloan was fined by NITDA for shaming its customers. It wasn’t meant to be so.

How it started

The credit idea is not new in Nigeria neither is it a recent invention in Africa.

This is not a new concept and many of us have already experienced it unknowingly. It occurs in many forms.

For instance, credit has always been part of the system and payment default didn’t just start with the Carbon and its friends. If you grew up in the 19th century in Nigeria, you would have noticed the sign “no credit today, come tomorrow”. That sign was born out of the frustration of borrowers not paying up.

The other sign is “business prospers when friends and family pay”. Again, this is a soft warning to friends and families because you’re dealing with some close relationships here.

Let’s drive it home.

Your neighbourhood store allowed you to purchase products throughout the month and kept a record of all your purchases. You then pay up either at the end of the month the accumulated amount or maybe weeks. This payment is usually interest-free and sometimes in instalments (grumbles.). That is 'Buy Now Pay Later'. When you call the store to book a product/service and informing them you don’t have full cash but will pay up at the end of the month. That’s BNPL enabled by technology.

The Growth. Some Numbers

Buy now, pay later (BNPL) is seeing some up north traction, and for good reasons: consumers see it as a way to stay within budget and away from loans and credit cards (which puts many people in debt).

Usually, BNPL does not come with interest except for fees added for the defaulters.

A statement in the BusinessWire on BNPL report stated; “BNPL providers in Africa have recorded strong growth over the last four quarters. Various players in the region are offering new forms of alternative credit and point-of-sale (POS) lending options such as BNPL to lure customers offering them a convenient and flexible payment model.”

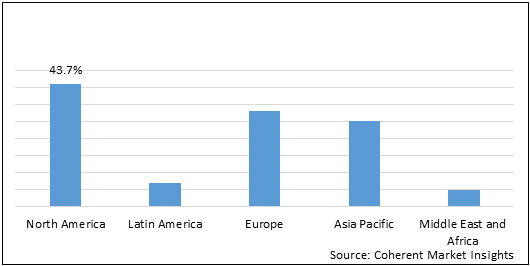

Also, A study performed by Coherent Market Insights reveals that the international BNPL market was valued at around $7.3 billion back in 2019. This nascent market is projected to reach about $33.6 billion during 2027, growing at an annual rate of approximately 21.2% between 2020 and 2027.

This growth is majorly attributed to a wide number of benefits offered by the buy now pay later platforms to its users – the buyers. Registering as a user to any of the BNPL platforms is very easy; nothing compares to what you get from the traditional banks. Once the account is created, the user submits bank details for credit/financial history. Scratch that. Services like Mono, OnePipe and Okra provides your credit/financial history which determines how they proceed with the user. Mostly, the user is approved where access is given based on the financial history. That’s for risk.

Referencing the crowdfund insider report, “Buy Now, Pay Later or BNPL adoption is on track to grow significantly in the next few years with the Asia-Pacific region being one of the main drivers.”

Several key global players lead the buy now pay later industry - Afterpay, Klarna and Zip Pay, which has a 25% stake in South African BNPL payment fintech, Payflex.

A recent report by Worldpay from FIS forecasts that BNPL services will steadily gain eCommerce market share, earning nearly 3% of global eCommerce spend by 2023. Similarly, IBISWorld predicts the BNPL industry will grow by 9.8% annually over the next five years to $1.1 billion.

But, what exactly is BNPL?

BNPL. What it is and the rise

BNPL is a shopping alternative that offers an option to consumers to take home their purchases while paying a fraction of the cost upfront. Most times, payment is in instalments.

It allows retailers – online and offline, to sell their products to customers who prefer to pay in instalments. In Africa, consumer behavioural changes that come with economic stress, a digital boom, and COVID-related job losses and pay cuts have BNPL positioned to take advantage of the challenges to offer more people ways to live within their budgets. Talk about inclusion.

They offer a “No interest benefit” and allows payment to be made in instalments.

A recent report by Global Web Index found 83% of consumers think brands should be providing flexibility in payment options.

Notwithstanding, this growth poses both an opportunity and a problem to the industry; as businesses team up with BNPLs, BNPLs experience a greater responsibility to only provide their services to verifiable partners.

As Affirm reported, 43% of new users prefer to use the company’s pay over-time services as it helps them stay within budget.

What was the alternative?

Credit Cards.Credit card companies filled in this gap for a long time. But there are problems associated with using credit cards - exorbitant fees, that leads people into debt. While the pandemic left many jobless, it taught millennials and Gen Zers — a growing demographic with more than $200 billion in spending power — the hard way of sorting out their debt issues. In turn, a number of them have become debt-averse and increased their demand for better financing options.

Impact of Coronavirus (Covid-19) Pandemic

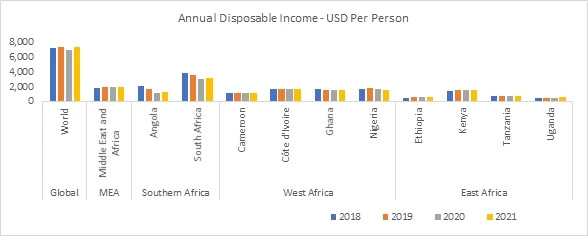

COVID-19 pandemic has adversely affected the economies of various countries across the globe. According to the International Monetary Fund Analysis, the global economy is expected to shrink by 3% percent in the year 2020 compared to year 2019. Along with the decreasing GDP, the purchasing power of consumers across the globe decreased.

Transforming retail

The world of retail is transforming with the changing pace of consumer behaviour. Payments powers commerce and plays a critical role in purchasing processes; being adjusted to the demands of consumers. Consumers will always correct the market.

Merchants are constantly looking for solutions that match consumer preferences, and consumers are also looking for more flexibility with how they pay.

As the rise of instant access to products and services continues, consumers can order now and pay later with little to no risk. BNPL takes it further, allowing consumers to enjoy the product before payment is complete.

With contraction on consumers buying power in Africa, BNPL looks like a saviour merchants have tirelessly waited for.

Competition Heats Up

Traditional banks have declared that they won’t be giving fintech space to breathe. Either by way of stimulating policies that either slows fintech growth or release similar products into the markets – which almost always don’t get the desired traction.

For instance, in Nigeria, GT Bank Hub Credit provides a spending limit of up to ₦1,000,000 and a minimum of ₦20,000 to shop on the Habari - its marketplace, payback is within 12 months at an interest rate of 21% per annum.

Consumers benefits

It provides the convenience of a credit card without needing an actual credit card. Consumers are decreasing their debts. Buy Now Pay Later provides the flexibility to access and enjoy the benefit of goods before making full payment.

A full credit check may not be required initially. Pay later companies can access information regarding the consumer, but the validation process is typically a much less rigorous check than with traditional methods.

Benefits for merchants

Lower cart abandonment rates. A Big Commerce 2018 omnichannel report shows that 31% of consumers only purchased a good or service because they had an option to Pay Later. Adding this method to the checkout process could help recoup some $34 billion worth of goods and services left in carts.

Consumers are enabled to spend more. By not paying upfront, shoppers tend to add more items into their cart that they wouldn’t normally do without the pay later option. The omnichannel report by BigCommerce indicates 36% of shoppers said that they spent more money.

Funds upfront. Lots of BNPL companies offer the full amount of the sales upfront to the merchant (sometimes with a percentage fee is giving to the BNPL company). This helps to keep cash flow as regular as possible.

Builds loyalty with consumers. This seamless shopping experience impresses consumers. It also takes out the friction of the buying process which leads to a more positive shopper experience. The added value of a more seamless process provides additional loyalty, and consumers are more likely to return to purchase again.

The problem.

While the BNPL model continuously strengthens its position in the global market, like every other payment model, BNPL too has a flipside.

The rising interest in BNPL has regulators in the United Kingdom and Singapore begin looking more closely at the potential risks involved with offering these payments services to consumers.

Fraud. Identity theft complaints in Australia involving BNPL doubled last year, creating a new record. The opportunity for fraud is high in this industry as it can come from both ends: customers using false identity information while illegitimate business partnerships can scam the BNPL. Because BNPL companies facilitate the credit to these clients, they need to ensure they are doing everything they possibly can to protect themselves from such fraudsters.

High Default Fees. One major factor restraining the growth of the global buy now pay later market is the increasing complaints of high default fees, which leads to debts. For instance, Afterpay charges $10 for each missed payment and $7 if the instalment remains unpaid after a week. The users who miss all the instalments are charged late fees of $68.

The unbanked and underbanked. However, there is one core challenge that the BNPL channel faces when it comes to underbanked and unbanked consumers. That is the lack of traditional bank accounts and/or cards.

BNPL startups in Africa.

The BNPL's like Carbon Zero, Aramex, Tabby, Shahry, Qesma, Postpay, Cashew, Tamara, Valu, Spotii are gaining a stronger foothold - replacing the much widely popular cash-on-delivery (COD). Tabby, Tamara, Postpay, and Spotii have cumulatively raised around $43 million for rolling out their operations in the region.

The future. What’s next for the Pay Later space?

Instalment payment a.k.a. BNPL is not new phenomenon.

For instance, making payment in instalments in Brazil, have been around since the 1950s, and as credit card access grew, instalments have become a core part of the online payment process. According to an Ebanx report, 54% of Brazilians who paid with a credit card also paid with instalments in 2017. As millennials and Gen-Z are now the world’s most powerful consumers, it’s no wonder that the buy-now-pay-later option is becoming more present on the checkout page.

The increased resurgence of BNPL through digital implementation is due to a combination of more tech-savvy consumers and improved technology by FinTech. Merchants who cannot build this functionality can easily integrate with a myriad of fintech – CredPal, Carbon Zero etc.

Due to the fast pace change in consumer behaviour, it’s still early to know how the groove brought by BNPL will pan out. But, it’s already clear that we’ll be seeing new entrants into this space coming with more innovative and seamless solutions for consumers. The growth of global BNPL players - Afterpay, Klarna and Splitit, indicate the value of this payment method. Ultimately, the success of pay later payment methods lie in the hands of the consumer.

Per a report by Coherent Market Insights, Europe, Middle East, and Africa are also expected to exhibit significant growth during the forecast period, owing to the entry of giant retailers in the BNPL industry. For instance, Marks and Spencer Group plc, a U.K.-based multinational retailer, started offering to buy now pay later services to its customers from October 2019.

Rounding off.

There is the issue of dealing with a trust deficit for online payment. The low financial inclusion means a widely popular cash-on-delivery (COD) payment model. However, the BNPL model is being actively embraced by more people, especially the millennials and Gen Z, as it assures them of receiving products first and is deemed as a great enabler for those in the lower-income bracket who find it convenient to break their purchases into flexible instalments. Again, financial inclusion.

The Worldpay’s 2020 Global Payments report projects that BNPL would account for 9% of the ecommerce payments by 2023 in the entire European, Middle East, and African region.

What We’re Reading and Watching

The Africa Creators Economy Explained (The Edition)

39 million Africans may fall into poverty this year, says Adesina (Guardian)

Klarna’s U.S. Chief: Expect a 12-Month ‘Land Grab’ in Buy Now, Pay Later Services (The Information)

Thank you for reading the Edition Newsletter! I’d love your feedback, ideas and tips:omamuzo@thespicenetwork.com

If you think someone else might enjoy this newsletter, please pass it forward or they can sign up here: https://africatechmemo.substack.com/

About Edition

Everything you need to know about the booming Africa tech and creator economy, from the platforms to the people to the deals. Start reading for free.

About Omamuzo Samson

Omamuzo Samson is a writer at The Spice Network writing about the tech and creator economy. He also works as a Product Marketer at Curacel. Based in Lagos, he can be reached at omamuzosamson@gmail.com or on LinkedIn at omamuzo-samson.

Image: carbon zero