How To Create A Budget In 10 Easy Steps

In this article, we’ll show you how to create a budget that works in Nigeria. Let’s go!

Greetings!

Id El Maulud is a day set aside to celebrate the birth of the Holy Prophet Muhammad.

And also, that means we have just 3 months to the end of the year!

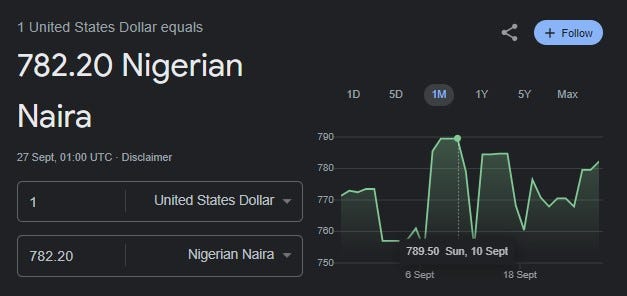

Check out today’s exchange rate here!

Wow, what a time to be a Nigerian. So much uncertainty surrounding the economy, market forces, hikes in school fees, inflation, surging petrol prices, CBN-driven monetary policies, and even the student loan saga and so on - the list is endless. In spite of all these though, we move on as one of our most common phrases, especially in our universities says "A luta continua; vitória é certa". We can have victory over sapa and its cohorts, and one way to do that is through effective budgeting.

A budget can be one of your best defences against sapa and a trusty tool in your journey to wealth creation — no matter how much you earn. But do you know exactly how to create a budget? Well, that’s what we are here to help you figure out.

You can create a budget by setting a realistic budgeting goal, deciding on a budgeting period and reviewing your income for that period. Then, you’ll need to list and label your expenses, set a spending limit and savings goal and adjust your budget.

We are talking personal budget.

A personal or household budget is a plan for coordinating the resources (income) and expenses of an individual or a household. - Wikipedia

Alright now, let's put sapa to flight with these 10 simple steps on How to create a budget

In this article, we’ll show you how to create a budget that works in Nigeria. Let’s go!

1. Prepare all the tools you’ll need to create a budget

You’ll need a pen, paper and a spreadsheet or budgeting app (You can start with Moor Pay's app). You might also need to open your spending or bank app (Moor Pay's app again) to review your income and previous expenses. Track your income and expenses. Tracking every part of your finances can help you understand your money and aid your budgeting efforts. Still, keeping a detailed record can be exhausting, so we recommend using (Moor Pay’s app) to ensure you always have access to detailed records.

2. Set a realistic budgeting goal

This step might seem odd, but having an end goal in mind can help you make a fantastic practical budget. Decide on the purpose of the budget and write (or type) it down. For example, you could create a budget for that much-needed vacation and name it “Are we there yet?”.

3. Create a realistic budget based on your income and expenses.

Don’t try to copy someone else or set unattainable goals. For example, you might need to set aside more money to eat out if you’re too busy to cook.

4. Review your income for the budgeting period

Write down your salary, wages, allowances and every other source of income you have coming in. Add them all up and note it down in your notebook, spreadsheet or budgeting app.

Download the Moor Pay app! And start saving stress-free today.

5. List your expenses for the period

Write everything down — from your cable subscription and data subscription to food items and “chop life” money. You can use your payments or banking app (Moor Pay's app) to review the previous period’s expenses if you have trouble remembering everything

6. Label your expenses as fixed or variable

Fixed expenses are unavoidable and include electricity bills, food and health insurance. Variable expenses, however, are more flexible and include items like your Netflix subscription and gym membership. Note: Always prioritize essentials. Your needs (fixed expenses) must always come first when you’re creating a budget. For example, getting a new phone when your rent is due is not a great idea.

7. Calculate your budget surplus or deficit

You can do this by subtracting your overall expenses from your total income. This step will help you decide what items to remove or add to your budget. You can also use it to determine the minimum (or exact) spending amount you need for your budgeting period.

8. Set a spending limit

You can apply the 50/30/20 rule when setting a spending limit by allocating 50% of your income to your needs and 30% to your wants. The remaining 20% should go into savings, investments and debt servicing.

9. Create a savings goal

Saving is essential to any budget, and we recommend simplifying the process using Moor Pay's spend and save feature to get returns of up to 15% — depending on the plan you use. You can save any amount, but putting aside 20% of your income is a great place to start.

10. Make adjustments to your budget

The purpose of a budget is to give you control, so don’t be afraid to tweak things if your original budget isn’t working for you. In fact, we recommend reviewing your budget as often as possible to ensure it fits your spending habits and income level.

See, It’s that easy!

Follow these tips, and you should be able to make the most of your money even if $1 is exchanged for ₦1,000.

Note that the steps we shared above are for creating personal budgets, and might not necessarily work for other types of budgets. Still, the steps are handy and tailored for the Nigerian experience, so you can try creating yours right now!

A note of caution: While budgeting can be super effective, some common mistakes (like setting unrealistic goals) can affect the impact of your spending plan or even discourage you from budgeting. Avoid them!

P.S.: One way to start saving without all the stress that comes with it. Use the Moor Pay “Spend + Save” feature. What it simply does is take a percentage of your spending and save it for you. The good part? You can withdraw it anytime you want.

Happy Id El Maulud to all of our Muslim friends!

Dafe.

This is really good

Well done👏👏👏