Insights: Nigeria's Payment Outlook 2024 by Techcabal

Nigeria’s payment system is changing. Over the past two decades, the payment system has undergone a significant transformation, transitioning from a manual clearing system with few stakeholders

Greetings,

To read the full report, do so here.

Below is my take, what I find interesting in the report and some interesting screenshots you will enjoy looking at 😁.

First, it is good to note that the main goal of Nigeria’s payment system is to ascertain that the country’s financial system works without backlogs.

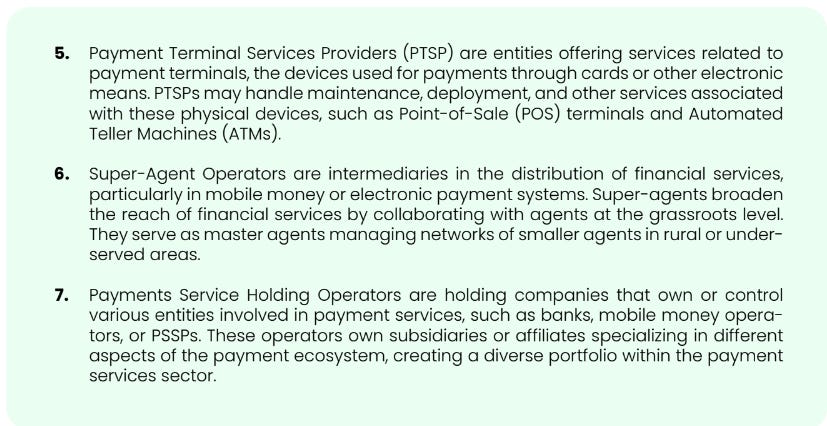

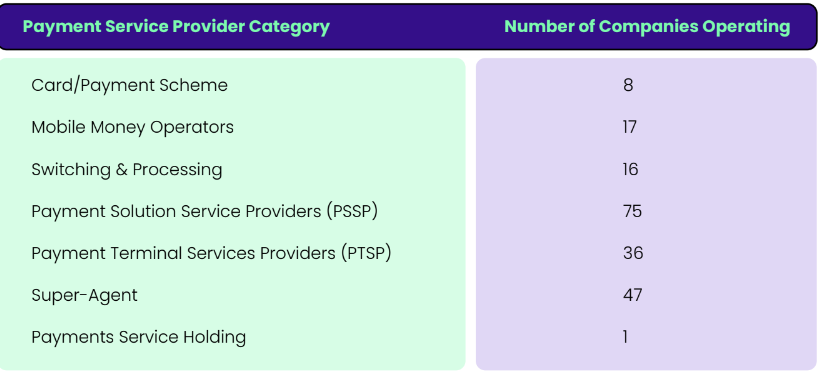

Also, key players include card payment schemes, mobile money operators, switching and processing companies, payment solution services, and payment service holding companies.

The numbers below are interesting, especially on the fact that when I see CWG listed with other fintech like Moniepoint, I always go back to their website to be sure it is the same Computer Warehouse Group (website) that I know. Enjoy the transaction numbers below, and see how they compare in years, volume and value.

In 2021, 35.5% of Nigerians above 15 had a debit card with Verve claiming to issue around 35 million active payment cards in 2022.

Moniepoint with $100 billion in 2022 transactions is the biggest Switching & Processing platform. eTranzact with an annual transaction value of 50 trillion naira ($34.5 billion2) is the second biggest Switching & Processing player. Flutterwave follows it with $9 billion.

For PSSP players, Nomba, Fluttwerwave and Appzone lead with $1 billion in monthly transactions, $9 billion in transactions and $2 billion in transactions respectively.

Nomba, Wi-Pay and Computer Warehouse Group are the biggest PTSP players with Wi-Pay and Computer Warehouse Group transacting over $3 million and 1.7 billion naira respectively.

Super-agents are perhaps one of the most popular payment providers as

they are the ones directly “on the ground” with ordinary Nigerians. Kippa, which processes $3 billion transactions with over 500,000 agents, MTN’s MoMo with over 700,000 agents and Nomba with over 300,000 agents are the most important

players in the super-agent category.

In 2021 the CBN reported a total volume of 1.59 billion ATM transactions, which decreased to 1.51 billion in 2022, indicating a -5.77% change in transaction volume. Conversely, the total transaction value saw a significant increase, growing from 21.23 trillion naira in 2021 to 32.64 trillion naira in 2022, reflecting a substantial 53.78% year-on-year growth.

Online transfers, with a total volume of 10.32 trillion in 2021, increased by 36.26% to 14.06 trillion in 2022. The total transaction value for online transfers grew from 545.03 trillion naira in 2021 to 783.66 trillion naira in 2022, marking a substantial 43.78% year-on-year increase.

Unstructured Supplementary Service Data (USSD) transfers, with a total volume of 552.91 billion in 2021, decreased to 516.08 billion in 2022, reflecting a -6.66% change in transaction volume. The total transaction value for USSD transfers also decreased from 5.17 trillion naira in 2021 to 4.49 trillion naira in 2022, marking a 13.23% year-on-year decrease.

Direct debit transfers experienced a 46.22% transaction volume growth, from 103.27 billion in 2021 to 151.01 billion in 2022. The total transaction value for direct debits increased from 23.01 trillion naira in 2021 to 26.40 trillion naira in 2022, marking a 14.76% year-on-year growth.

Mobile Money Operators (MMOs) transfers in Nigeria witnessed a remarkable 151.18% change in total volume, surging from 248.5 million in 2021 to 714.5 million in 2022. Concurrently, the total transaction value increased from 8.06 trillion naira in 2021 to 19.4 trillion naira in 2022, marking a significant 140.73%

year-on-year increase.

Point of Sale (POS) transfers in Nigeria saw a significant 17.00% change in total volume, increasing from 982.83 million in 2021 to 1.14 billion in 2022. Concurrently, the total transaction value rose from 6.43 trillion naira in 2021 to 8.39 trillion naira in 2022, representing a notable 30.42% year-on-year increase.

Consumer trends, influenced by factors like financial inclusion, mobile money awareness, and regulatory restrictions, highlight areas for improvement.

To understand the impact of these policies on financial inclusion, the Enhancing

Financial Innovation and Access (EFInA) reports show Nigeria’s financial inclusion

data from 2008 to 2020. In 2008, 52.5% or 45.4 million Nigerian adults were financially excluded.

Within the horizon of the PSV2020 then, Nigeria went from over half

its population being excluded from the financial and payment system to only 35%

in 2020, when the PSV2020 ended.

In 2013, the average Nigerian transacted 65% of their income earned in cash [2]. Despite the fees levied on cash withdrawals since the commencement of PSV2020, cash use remains high with some sources stating that 90% of transactions are still cash-based post-PSV2020 [3]. This has unfortunately led to inflationary spirals which affects the very Nigerians the cashless policy, driven by PSV2020, was meant to help and support.

The CBN has four main roles it plays in Nigeria’s payment system: financial intermediation, transaction settlement, minimizing risks and fostering monetary stability by offering a robust framework for financial transactions.

I found some interesting Insights also…

Computer Warehouse Group has the PTSP license and categorised as one of the biggest players in the Nigeria fintech space.

While the future appears promising, regulatory challenges loom.

Interswitch is the only company with a payments service holding license, making its role and dominance uncontested.

The market landscape for PSBs, for example, is a tightly contested one. The customer base for PSBs in the country is around 30 million according to GSMA.115 PSBs have a unique licensing position that specifies them to provide access points to consumers in rural areas. Given this position, customer growth for PSBs is highest in rural areas because of the amount of unbanked and underbanked adults in those areas. The problem with such a customer base, however, from a business perspective, is their profitability and potential for high-value transactions over the long run.

The main revenue channels for PSBs are cash-in cash-out (CICO), transaction fees from cash transfers and collections. Innovation with this revenue model is difficult as these are the revenue models defined by the existing regulatory framework. For this reason, PSBs would not be able to offer credit to their customer base even though they might be the closest access to finance such customers might have.

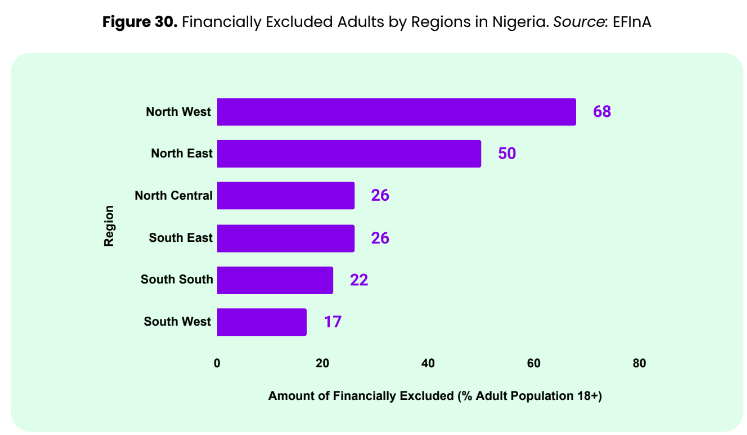

In a similar vein, the cost of acquiring customers in the north is also much higher due to the amount of people excluded in the financial system.116 The cost is higher because a lot of energy and resources would have to be put into financial literacy and education. These are resources that would otherwise have been used for improving core business products and services.

The northwest has 68% of its adult population excluded from the payment system. Similar instances stand in the northeast where 50% of the adult population are also outside the payment system. This is in contrast to any of the three southern regions where the most excluded region only has 26% of its adult population excluded from the financial

The same situation is true for women as more Nigerian women, 40%, are excluded from the financial system entirely relative to men, at 32%. For these kinds of customer base, agency banking will be a much more progressive customer acquisition strategy as it will be the most cost-effective whilst providing a sufficient amount of customer satisfaction payment system.

Other insights but tilted…

Things I love (Insight): Kora's growth analysis revolves around five crucial points: new customer acquisition, transaction volume, revenue growth, profitability, and the total value of transactions. By scrutinizing these facets, the company gains a comprehensive understanding of its performance and sustainability.

Things I love (Insight): Duplo addresses the challenges logistics businesses face in managing payments to drivers, handling collections from customers, and efficiently handling petty cash. For instance, we've facilitated solutions for drivers in remote areas, enabling them to pay for fuel seamlessly. Secondly, the construction sector has embraced our platform. Construction firms, dealing with numerous suppliers across diverse requirements, benefit from our streamlined approach to payments. We aim to simplify how these firms transact with their vendors, ensuring security and transparency in the process.

Interesting screenshots…

Hope you enjoyed the insight blipped shared 💓💓

Omamuzo Samson.