🎶 Oh Jingle bells, jingle bells, jingle all the way, oh what fun it is to ride on a one-horse open sleigh🎶.

Hi and Good morning.

The above lyrics are one of the most played Christmas songs, cutting across several generations. Alright now, don't be alarmed, this article is definitely not about Christmas song lyrics, rather I just want it to sink into your subconscious in case you're thinking it's still a long way to the Yuletide season - newsflash it's just around the corner. So, how are you preparing for it, how do you intend to have a wonderful Christmas, and what steps have you taken or planning to take to ensure this Xmas season will be one of joy and not sadness 😔.

Without an iota of doubt, having a healthy financial status will be crucial in the way you celebrate this festive season. This is why I want to once again talk about having a savings plan - it's absolutely necessary.

Why is it important to save?

Probably, you may be asking yourself the above question. Now let's assume you're spontaneously faced with a really difficult situation, for instance, a loved one got into an accident and needs urgent medical attention, how would you feel if just because of a little token, that loved one of yours lost his or her life or sustains a permanent loss to the proper functioning of a part of the body all because you couldn't deposit a little money - which you know - as a matter of fact, should not really be a challenge to you but now is, all because you never developed a savings habit.🤦🏾♂️😔😩.

Apart from the above sad picture I painted, these are other good reasons why having a savings plan is important.

Meeting life goals

Let’s face it, many of our life goals aren’t free. Anything from pursuing higher education to buying a home requires a certain amount of funding, which you’ll need to plan ahead for.

If you have future goals — a big vacation, a child’s education, upgrading your home or vehicle — it can be important to begin saving now so you have the funds available when you are ready to achieve those goals.

The sooner you start saving for your goals, the more likely you’ll achieve them faster. It’s important to list your various goals and develop savings strategies for both short-term goals (such as a vacation or down payment on a house) and long-term goals (such as opening a business or retirement).

Relieve financial stress

Financial uncertainty and unexpected expenses can take a significant toll on your mental well-being. However, establishing consistent savings habits is one way to counteract financial stress.

Helping others

Once you get to a point in saving where you feel comfortable with your various savings funds and have grown your wealth, you’re also able to support causes that go beyond individual goals. That could mean helping out a friend or family member in need or donating to a charity that you care about.

And so on and so forth!

What savings plan can I start?

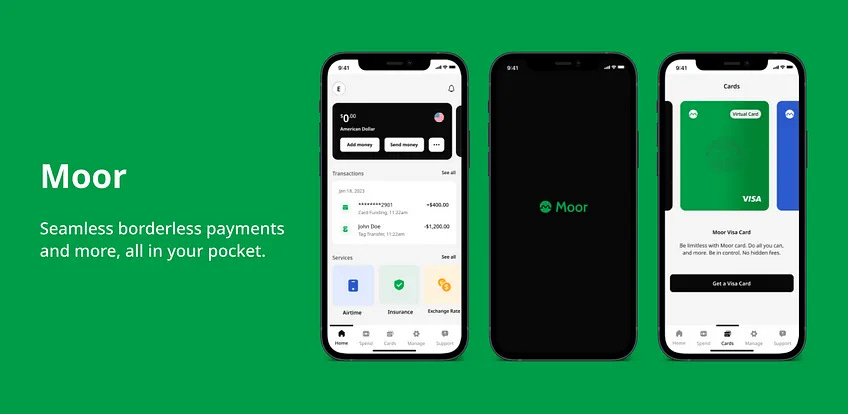

Well, that's where I and by extension, Moor Pay comes in. Let me introduce to you one of our amazing features called Moor Pay Save + Spend with approximately 60 days to the Christmas holidays, I would like to assure and assist you in starting up this amazing plan which fits perfectly 👌 for you to achieve your short term goals of having a blissful festivities.

What exactly is the save + spend feature?

Moor Pay's save + spend is a savings product that encourages users to save a percentage of any amount they spend.

Let’s say you set the percentage to 5%, you’ll effectively be saving 5% of any money you spend or withdraw from your opay account.

Who is Moor Pay save + spend for? Moor Pay save + spend is for individuals who want to save a fraction anytime they spend, this can be helpful in the long run, as you are not only spending but also saving and getting interest on your savings.

The aim here should not be the interest earned, but what you are able to save which is exactly why I am confident that in the next 60days leading up to the Christmas period, if sincerely give this plan a go, setting a high percentage savings rate, you should be having a joyous Christmas holidays. Download the app immediately and let's help you sing 😉 the jingles merrily.

Download the Moor Pay app now!

Note: Complete FAQs on all the savings types can be found on the Moor pay app.

How to locate the save + spend feature:

Open the Moor Pay app

Click on spend (bottom navigation)

Click on savings

Create a Pocket by clicking the Create Pocket (bottom of your screen)

Continue to click on the continue tab ( bottom of your screen) and follow the guidelines. It's really not difficult.

You can contact our customer care personnel. Send me an email at o@zaidi.com.ng or SMS/WhatsApp - 0916 217 1134. And I will respond as fast as possible.

Now that you’ve got to know about Moor Pay savings + spend product, I’ll leave it to you to decide when you want to begin. Meanwhile, you are not limited in the number of Moor Pay savings types you can use at a time, so you can choose to use all, there’s absolutely no problem.

Dafe.