The Briefing: FairMoney acquires PayForce

We are still celebrating the International Women's month. But, a lot has happened that we cannot ignore.

Greetings!

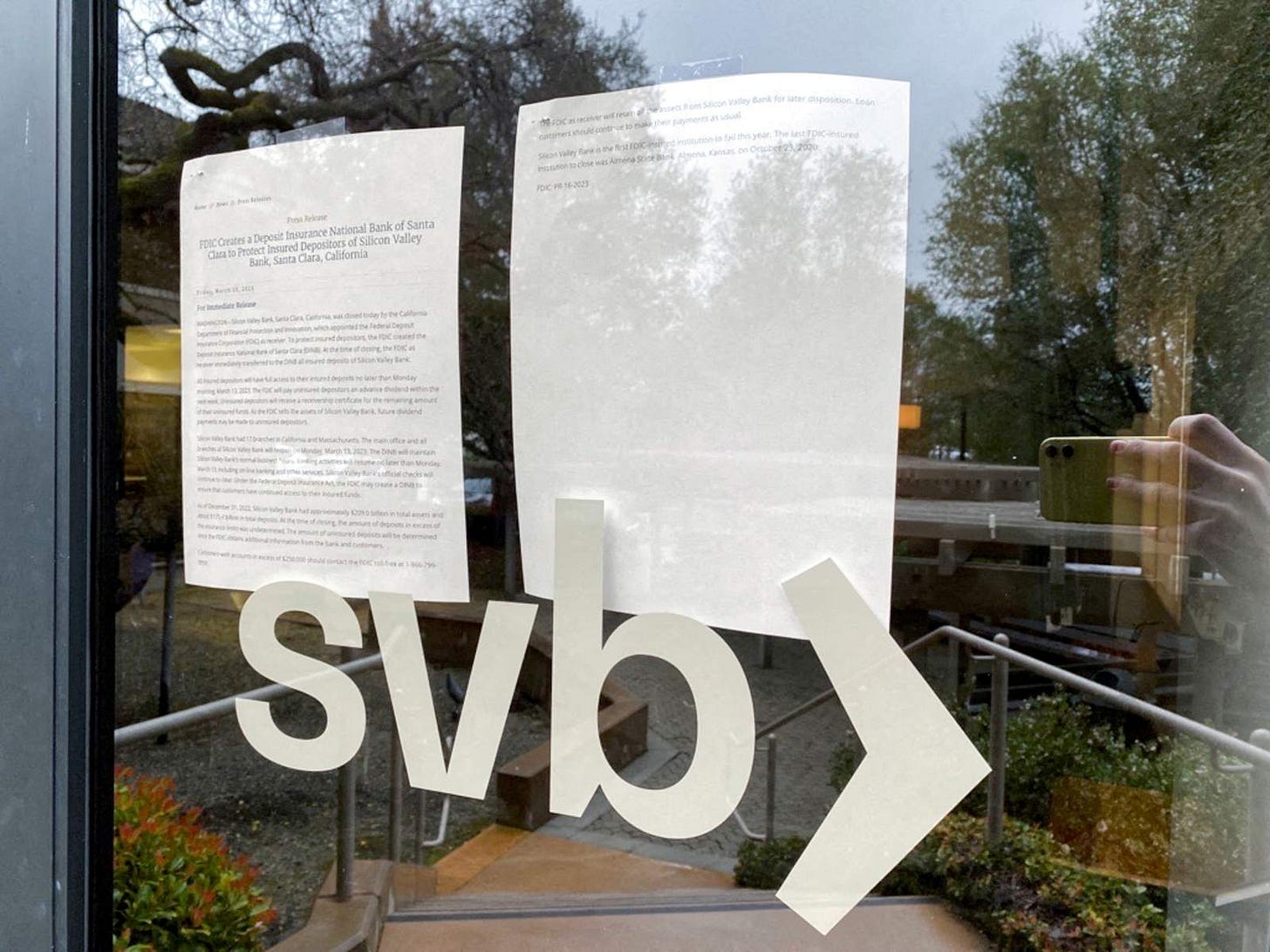

Last week saw the collapse of one of the most important banks in the US - SVB. It was devastating news especially as startups couldn’t make payroll. Some African startups were exposed while those not exposed, fear the ripple effect it will have. Like we say in Africa. “thank God!”. HSBC acquired SVB and the US govt. has taken steps to protect customers from the hurt. What a relief.

I do not have many briefs to write today except to tell those in Nigeria to come out and vote for a better governorship candidate that can pull strings from them just as the Uk and US governments just did with the collapse of SVB.

But, how can your rep pull such strings if he doesn’t understand how things work except by forgery, corruption and lies? It’s still The Briefing - Samson.

For Adverts, send us an email - at giantaffairs@gmail.com OR call - 08074727030 | See Africa Tech Memo Ad Rate

Quick Stats.

The number of women in the workplace was highest in 2019. There were 79,457,808 women in the workforce, or a share of 47.4%. Only 32.2% of women were employed in the top 10 occupations.

Lagos-based EchoVC launches $8m “pilot” blockchain-focused seed fund

Lagos-based VC firm EchoVC, a technology-focused early-stage VC firm focused on investing in underrepresented founders and underserved markets have launched EchoVC Chain, a US$8 million “pilot” blockchain-focused seed fund. “Over the past few years at EchoVC, we have become intrigued with blockchains. The more we explored, and learned, the more excited we’ve become about the applications of blockchain and its functions in Africa,” said the firm’s Eghosa Omoigui, Tsendai Chagwedera and Deji Sasegbon in a blog post. Disrupt-Africa

Nigerian credit-led fintech FairMoney acquires PayForce in retail-merchant banking play

Nigerian credit-led digital banking platform FairMoney has acquired PayForce (a sub-brand of YC-backed CrowdForce), a merchant payment service that serves small businesses, as the digital lender looks to broaden its financial services proposition to merchants. TechCrunch

Vodacom Tanzania awards top tech start-ups with $85k

Vodacom Tanzania, in partnership with Smart Lab, has announced the three winners of the second season of its digital accelerator programme. The top three start-ups were selected after a competitive pitching event and public voting process, with the winners set to receive a combined total of over TZS 200 million (about $85 500) in value-based support and follow-on investments. This year’s programme received over 700 applications and saw 12 start-ups selected to participate, from industries such as fintech, health, e-commerce, education, agriculture, and cybersecurity. Ventureburn

Flutterwave’s troubles in Kenya yet to end as second case proceeds

Africa’s most valuable unicorn Flutterwave is still not off the hook in Kenya. About $3 million of its money that was confiscated in the second government seizure over money laundering and fraud claims remains frozen, in two banks, and 19 mobile money accounts (M-pesa paybill numbers), as the matter is before Kenya’s high court. The $3 million funds seizure happened late August last year, less than two months after Kenyan court froze $52.5 million from Flutterwave and other entities. With each seizure, the country’s Assets Recovery Agency (ARA), a state agency tasked with tracing proceeds of crime, filed a suit. TechCrunch

MTN Nigeria allots 4 million incentive shares to shareholders

To draw a good number of investors to the offer for sale, the local unit of Africa’s biggest wireless operator MTN Group said it will give 1 extra share for every 20 bought and allotted. That was subject to a maximum of 250 shares, a decision MTN said it took to enhance retail participation. The offer was 139.5 per cent subscribed, prompting roughly 665.2 million shares to be allotted in all. “120,359 investors, representing 94.77% of those who participated in the Offer, qualified to receive the Incentive Shares totalling 3,977,418 ordinary shares of MTN Nigeria,” the company said in a note posted on the Nigerian Exchange’s website Wednesday. Premium Times

Israeli Startups Could Face ‘Frozen’ Funding Environment Amid Political Turmoil

Over the last seven years, fintech Papaya Global has become one of Israel’s most successful startups, raising hundreds of millions of dollars to build out its HR and payroll platform. But in late January, Papaya CEO Eynat Guez moved the company’s funds out of Israel, citing the country’s risky business climate amid political turmoil. She joins a growing group of tech leaders alarmed about Prime Minister Benjamin Netanyahu‘s plans to give parliament veto powers over the Supreme Court. Crunchbase

AfCFTA Secretariat, Afreximbank Sign Adjustment Fund Host Country Agreement with Rwanda

The AfCFTA Secretariat and African Export-Import Bank (Afreximbank) has signed the Host Country Agreement for the AfCFTA Adjustment Fund with the Republic of Rwanda. The Agreement paves the way for the operationalisation of the AfCFTA Adjustment Fund. The $10 billion Fund, headquartered in Kigali, Rwanda, is a critical instrument in the realisation of the African Continental Free Trade Area. This would help countries implement agreed protocols and support African companies to retool for effective participation in the new trading regime. ThisDayLive

SA tech firms commit to hiring more women

According to a PwC report, women presently hold only 19% of tech-related roles at the world's top 10 technology corporations, compared to men, who hold 81%. As the world commemorated International Women’s Day yesterday, local tech firms marked the day by reinforcing their commitment to hiring more female employees. They highlighted efforts to foster a diverse and inclusive workplace as part of their organisational structure. IT Web

Silicon Valley Bank collapse leaves dozens of local startups in the lurch

The implosion of Silicon Valley Bank (SVB) last week has likely left scores of Egyptian startups without access to deposits they parked at the bank, according to industry players we spoke with yesterday. The collapse of the bank — the second-largest in US history (see sidebar, below) — has left companies across the world, most of them tech startups, scrambling to find the means of meeting payroll and other operational expenses while US regulators try to sort out the mess. Enterprise

Naspers shuts down South Africa’s largest VC fund

Africa’s most valuable company by market capitalisation, Naspers, has shut down its venture capital fund Naspers Foundry in an effort to scale down its operations. Post the sunsetting of the fund, the Foundry will continue to maintain the investments it has made which include in startups like Naked Insurance, SweepSouth, and most recently, Planet42’s $100 million mega-round. “The global investment environment, as well as the local SA one, has changed and we have made clear the need for our business to adapt,” a Naspers spokesperson told BusinessDay. TechCabal

Lessons learned from being Africa’s most active early-stage investor - Zachariah George, Managing Partner at Launch Africa Ventures

When I came to South Africa in 2010, little to nothing was happening in its VC landscape. Small Angel groups, friends and families funded most startups at the idea and MVP stage at the time. Zach is the Managing Partner at Launch Africa Ventures - Africa’s most active early-stage VC fund with a portfolio of 130+ tech companies across 20+ countries. BanjaminDada

What we are reading

Jack Ma Foundation’s Africa’s Business Heroes Initiative. Register

Google Pixel 7a Leaks Online. Pixel 7a features a 6’1 inch display and dual 12MP camera

*Sponsor a post

About The Briefing.

The Briefing is a quick bite briefing of African tech and business activities trending. The writers’ opinion on one huge trending topic that matters, followed by “In Other News” and “What We Are Reading”

This Briefing by Sam.

For Adverts, send us an email - at giantaffairs@gmail.com OR call - 08074727030 | See Africa Tech Memo Ad Rate